Story

Hudson Square Properties is a joint venture of Trinity Church Wall Street and Norges Bank Investment Management with Hines, the operating partner, of a 12 building portfolio of approximately 6 million rentable square feet.

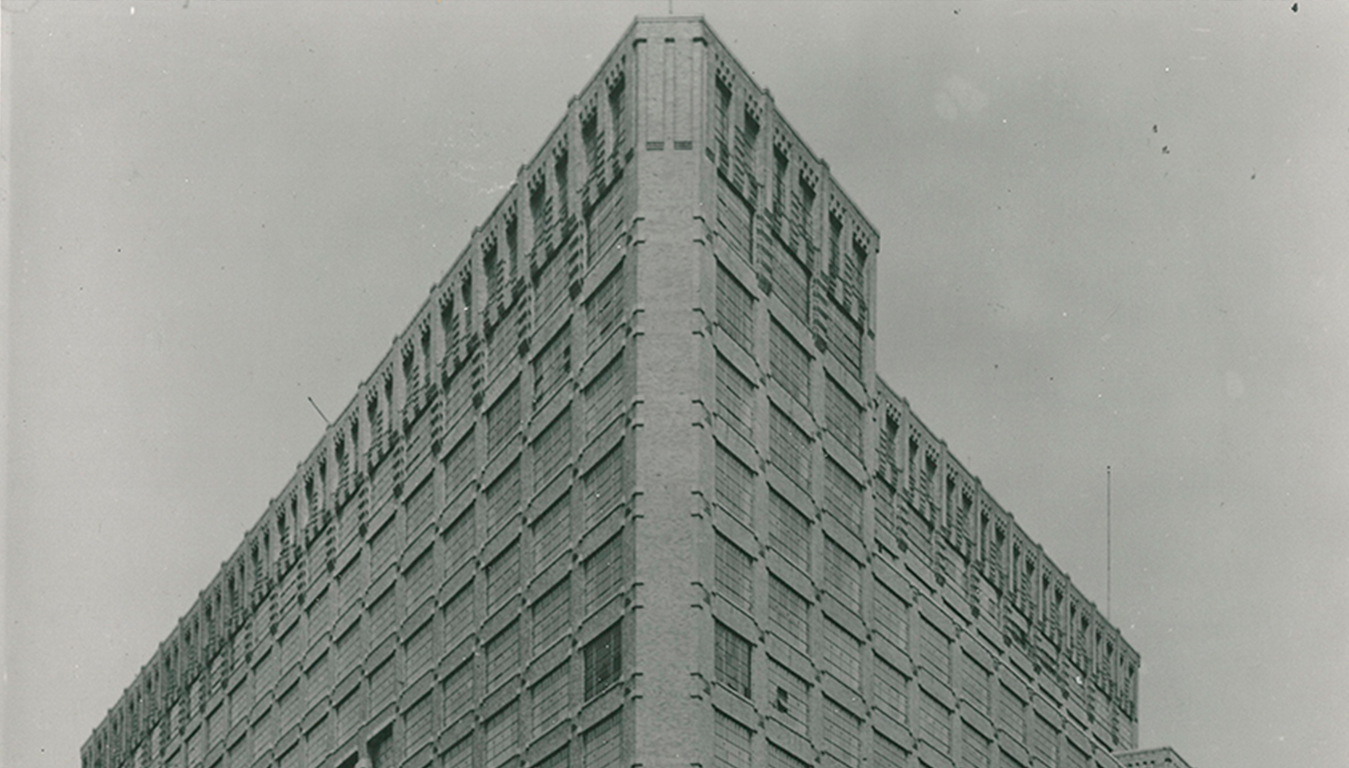

Trinity Church Wall Street has played a prominent role in lower Manhattan for more than 300 years. Its history in the Hudson Square neighborhood dates back to the generous land grant given to the church by Queen Anne in 1705. Today, Trinity owns 14 acres in the vibrant and growing neighborhood, property that continues to provide resources for the church’s mission and ministries in New York City and around the world.

In December 2015, Trinity and Norges Bank Investment Management formed a joint venture partnership comprising 11 office buildings with 4.9 million square feet of commercial space in Hudson Square. In April 2016, the joint venture selected Hines as the operating partner for the portfolio. The office buildings on the properties are being redeveloped into a hub for creative industries and businesses that are drawn by the energy of this vibrant neighborhood and the flexibility of the space.

Over the last decade, the portfolio has invested significantly in energy and sustainability improvements, including switching from using fuel oil as a heating source to cleaner burning natural gas, installing modern HVAC control systems and automatic water and energy meters.

More recently, the portfolio has chosen to respond to the Global Real Estate Sustainability Benchmark (GRESB), which assesses the sustainability performance of leading real estate portfolios and assets worldwide. Assessment participants receive comparative business intelligence on where they stand against their peers, a roadmap with the actions they can take to improve their Environmental Social and Governance performance and a communication platform to engage with investors.

Most recently, the entire portfolio is pursuing LEED Gold certification using the LEED Performance Score program which is expected in mid-2019.

Individual Building Sustainability and Energy Efficiency Accomplishments 75 Varick Street: LEED Silver certified, LEED Gold certification in progress 345 Hudson Street: LEED Gold certification

TRINITY CHURCH WALL STREET

“Trinity Church Wall Street has played a prominent role in lower Manhattan for more than 300 years.”

ABOUT TRINITY CHURCH WALL STREET

Trinity Church Wall Street is a growing and inclusive Episcopal parish that seeks to serve and heal the world by building neighborhoods that live Gospel truths, generations of faithful leaders, and sustainable communities. The parish is guided by its core values: faith, integrity, inclusiveness, compassion, social justice, and stewardship. Members come from the five boroughs of New York City and surrounding areas to form a racially, ethnically, and economically diverse congregation. More than 20 worship services are offered every week at its historic sanctuaries, Trinity Church and St. Paul’s Chapel, the cornerstones of the parish’s community life, worship, and mission, and online at trinitywallstreet.org. The parish welcomes approximately 2.5 million visitors per year.

NORGES BANK INVESTMENT MANAGEMENT

“The fund owns direct real estate investments totaling nearly 800 assets across 13 countries.”

ABOUT NORGES BANK INVESTMENT MANAGEMENT

Norges Bank Investment Management manages approximately $27 billion in direct real estate investments on behalf of the Norwegian Government Pension Fund Global, totaling $1,020 billion of assets across equity, fixed income and real estate. The fund’s mission is to safeguard financial wealth for future generations. Norges Bank Investment Management continues to invest in three target asset classes – office, retail and logistics. Investments in office and retail are focused across a limited number of global cities in Europe, the US and Asia that have key fundamentals including transparency, liquidity, supply restrictions and the potential for economic growth. Investments in logistics are located across Europe and the US with a strategic focus on proximity to large metropolitan markets and key global distribution networks. The fund owns direct real estate investments totaling nearly 800 assets across 13 countries. In the US, the fund owns direct real estate investments across 22 million square feet of office and retail properties in New York City, Boston, Washington DC and San Francisco. Visit https://www.nbim.no/ for more information.

HINES

“Hines is one of the largest and most-respected real estate organizations in the world.”

ABOUT HINES

Hines is a privately owned global real estate investment firm founded in 1957 with a presence in 207 cities in 24 countries. Hines has approximately $116.4 billion of assets under management, including $64 billion for which Hines provides fiduciary investment management services, and $52.4 billion for which Hines provides third-party property-level services. The firm has 109 developments currently underway around the world. Historically, Hines has developed, redeveloped or acquired 1,319 properties, totaling over 431 million square feet. The firm’s current property and asset management portfolio includes 527 properties, representing over 224 million square feet. With extensive experience in investments across the risk spectrum and all property types, and a pioneering commitment to sustainability, Hines is one of the largest and most-respected real estate organizations in the world. Visit www.hines.com for more information.